There’s an old saying that goes “nothing breeds competition, like competition” and nothing could be more correct in Tesla’s case. Elon Musk has been so distracted with gigantic successes at SpaceX, massive failures at Twitter / X, and needless public relations crisis, that he is not definitely not brought his “A game” to Tesla in the last year.

Mr. Musk is focusing Tesla’s efforts on robotaxis because he feels Tesla is far ahead of its competition. However, this could be a classic business mistake, allowing distant rivals to catch up. This is similar to what happened when Compaq replaced Osborne computers, Apple replaced Blackberry, and Toyota replaced General Motors.

The big difference this time is that Musk seems to be aware of the Chinese but just energized to do much about them. Mr Musk is obviously a very competitive individual and so having the Chinese provide strong competition in the entry level EV space in the coming months, may be what is needed to get him refocused.

As usual Elon Musk’s many announcements about the “unboxed assembly process” and the so called Model 2 $25,000 EV, are just vapor. “Elon Time” is always a long time away.

Despite his denials, rumors persist that the Tesla Model 2 is “canceled”. While Musk’s minions that they will start Model 2 production in Texas, the Mexican government is publicly angry that they can’t find out why Tesla hasn’t even got a shovel in the ground to start building the promised Model 2 factory.

Enter the Chinese.

About a year ago we wrote an article titled “The Chinese are Coming! The Chinese are Coming!“, And while we may have been a bit early in that call, the rest of the automotive press now seems to agree.

If you think the 27.5% tariff On Chinese made vehicles being imported to the United States will save the domestic industry, primarily Ford GM and Stelantis / Chrysler, you would be wrong. The average price of a Chinese made entry level electric vehicle is about USD $15,000, and that includes profit. Adding 27.5% to that would still make their vehicles half the price of Tesla’s lowest cost vehicle.

To make matters tougher for Tesla, BYD is building a substantive low cost electric vehicle manufacturing factory in Mexico. Mexico has a free trade agreement with the United States, Canada and dozens of other large wealthy countries, which will make a obvious entry point to the US and Canadian auto markets.

While BYD, who is already the largest electric vehicle company in the world and by most accounts is ahead of Tesla on virtually every metric, they are not alone in threatening Tesla’s supposed dominance. China’s JAC Motor and Cherry Automotive are also opening new factories in Mexico. Beyond those there are rumors of other Chinese EV juggernauts like NIO that are expected to announce New Mexican factories within the next couple of years.

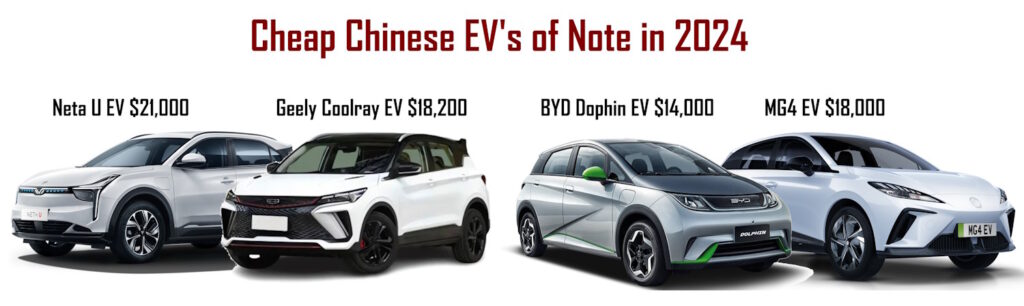

Top 5 Affordable Chinese EV’s That Could Be Sold In The US

These vehicles would obviously need to have some changes made to be sold in the North American market, but this list is excluding mini-cars and other vehicles that could not be sold in the US or Canada.

- BYD Seagull EV: Introduced in 2023, this model features a futuristic design and an incredible range of 405 km. It starts at USD $10,330.

- BYD Dolphin EV: This one looks a lot like a Chevy bolt and starts under USD $14,000.

- MG4 EV: Known as the MG Mulan in China, this compact hatchback is practical and has a sleek modern styling. It starts at USD $18,000.

- Geely Coolray EV: This is certainly no Chinese junk EV. This is a an attractive compact luxury sport EV that starts at USD $18,200

- NETA U: A cool crossover SUV manufactured by Hozon Auto from 2020. It implements a very futuristic design and is priced at USD $21,000.

… and one more for good measure:- AION Y: A compact crossover SUV with a smart design that maximizes efficiency and delivers an incredible range of 600 km. This one comes starts below $25,000

Elon Musk apparently believes Tesla can’t compete in the low-end EV market, so they’re ceding it to China. This raises questions about whether Musk is repeating the mistake made by General Motors, Ford, and Chrysler in the 70s and 80s. These companies didn’t compete with Toyota and Honda in the low-end market, allowing these Japanese companies to establish themselves in North America before moving upmarket. This strategy contributed to the financial struggles of the Big 3, with Ford narrowly avoiding bankruptcy in 2008.

Tesla said on their recent earnings call for investors that they actually intend to accelerate low cost electric vehicles. However, they didn’t explain what that means. It could very well mean that they are just going to come up with a cheaper model 3 come up with perhaps a smaller battery. If Tesla doesn’t bring out a sub $30,000 electric vehicle in mass volume with in the next 18 months their stock will be viciously punished.

0 Comments